Monthly Market Report

31st August 2025

1. Market Overview:

In August 2025, the Tanzanian capital market continued its upward trajectory, building on July’s strong performance. Market turnover rose by 12% compared to last month,

reaching TZS 108.99 billion from TZS 96.91 billion in July 2025. In the year-on-year comparison, turnover increased by 672.9% relative to the TZS 14.10 billion posted in August 2024.

This reflects the depth of liquidity and heightened investor activity.

Total market capitalization rose to TZS 22,110.10 billion in August 2025, a 5.3% monthly increase and 26% year-on-year rise from TZS 17,547.57 billion in August 2024.

Domestic market capitalization mirrored this growth, climbing to TZS 14,348.28 billion, an increase of 4.8% from July 2025 and 16.6% in YOY comparison.

Overall, August 2025 reflected robust performance driven by gains across major banking counters, cement producers, and domestic institutional investors.

2. Equity Market Performance

2.1 Index Movement

Both key indices posted gains in August 2025. The DSE All Share Index (DSEI) rose by 129.79 points, closing at 2,579.37 from 2,449.58 in July 2025, and 106.75points jumped year-on-year from August 2024 (2,102.43). The Tanzania Share Index (TSI) advanced by 247.06 points to close at 5,420.04, representing a 4.8% monthly gain and 16.7% points higher compared to August 2024, with 77.53 points (4,643.98). The sustained upward momentum underscores increased demand for financial and industrial counters

2.2 Turnover & Volume

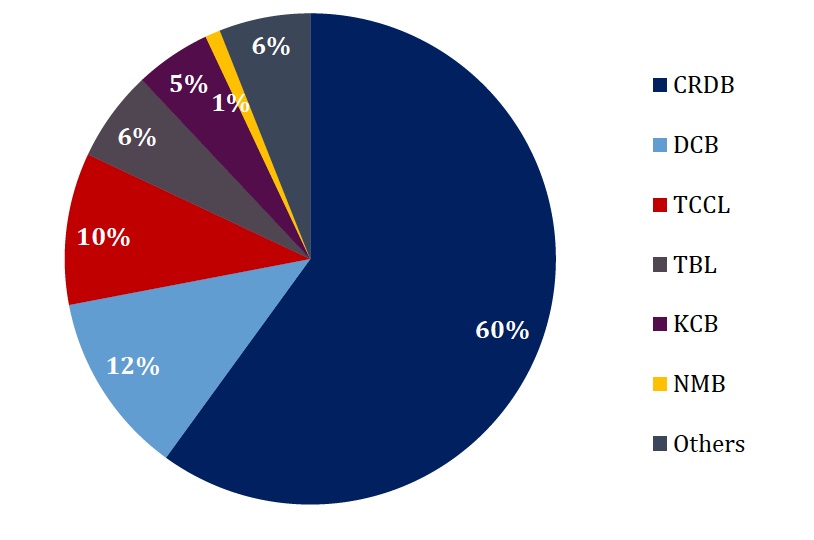

Equity turnover in August 2025 amounted to TZS 108.99 billion, up 12% from July’s TZS 96.91 billion. Despite this, trading volumes fell marginally by 3% to 61.45 million shares. Compared with August 2024, turnover grew nearly eightfold (from TZS 14.10 billion), while volumes expanded more than fourfold (from 13.87 million shares). Turnover diverged from volume since the stock’s price rose sharply, causing turnover to increase disproportionately relative to volume. Expect modest growth supported by DSE liquidity. Investors should watch the financial sector for potential opportunities. Cross-listed stocks such as KCB continue to add depth to the market, offering regional diversification.

2.3 Top Movers

Key top movers in August 2025 included;

▪ CRDB Bank Plc (CRDB) closed at TZS 1,260 with a weighted average price (WAP) of TZS 1,353. It traded 36.7 million shares worth/Turnover (TZS 49.72 billion, sustaining its dominance in market activity. CRDB gained 20% compared to last month and 88.1% year-to-date.

▪ NMB Bank Plc (NMB) closed at TZS 8,410 (WAP of TZS 8,093), trading 915,311 shares valued at TZS 7.41 billion. The counter advanced 14% MoM and 57.2% YTD.

▪ Tanga Cement Plc (TCCL) rose sharply to TZS 2,370, with a turnover of TZS 13.98 billion. The counter is up 19.7% MoM and 31.7% YTD, highlighting cement sector recovery.

▪ Tanzania Breweries Limited (TBL). Declined by 16.8% MoM to TZS 7,600, extending its YTD losses to 30.3% as consumer demand pressures weighed on the brewing sector.

▪ DCB Commercial Bank Plc (DCB) jumped to TZS 300 (WAP of TZS 242), trading 7.16M shares, with a turnover of 1.73B, surged 100% MoM and 122.2%YTD, making it one of the top gainers.

▪ KCB GROUP (KCB) closed at TZS 1140 (WAP of TZS 1096), and turnover grew by 56.2% (YTD) to TZS 3.7B.

Figure 1: Equities Contribution in the Market

3. Bond Market Update:

In August 2025, the bond market exhibited mixed performance, marked by strong participation in primary market auctions alongside activity in the secondary market. The Bank of Tanzania (BoT) reopened two bonds; as to primary market activity conducted,

the Bank of Tanzania (BoT) successfully reopened two government bonds: A 25-year treasury bond with a coupon rate of 15.00% (average yield to maturity was 14.4239%) and a 15-year treasury bond with a coupon rate of 14.5% (average yield to maturity was 13.907%).

Both issues saw oversubscription, with total tenders amounting to TZS 1,228.66 bln for the 25-year treasury bond and TZS 668.69 bln for the 15-year treasury bond.

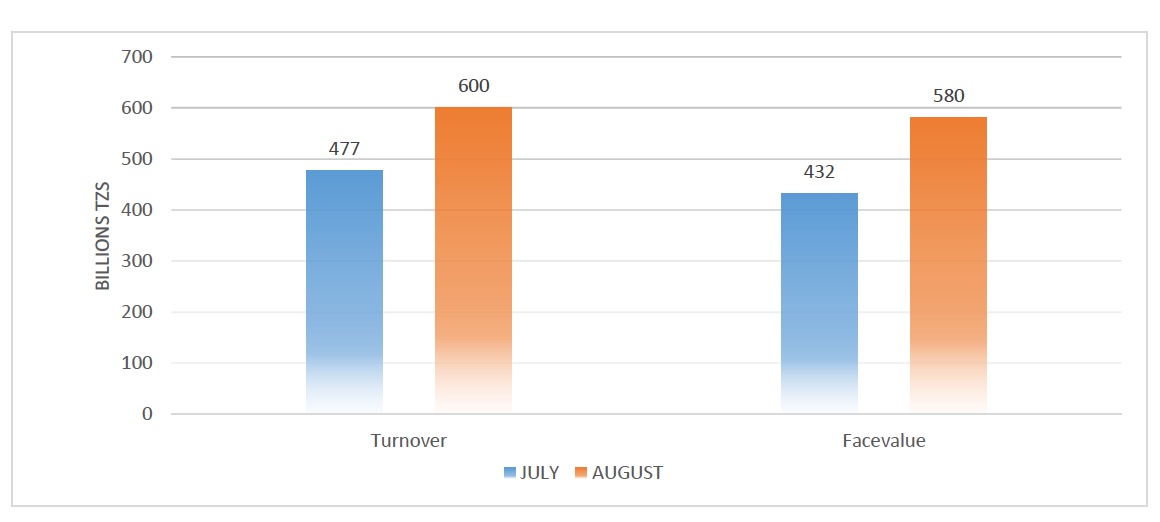

The secondary bond market registered robust activity in August 2025, with turnover climbing to TZS 600.07 billion, 26% increase from July’s TZS 477.24 billion. Face value traded also rose by 34% to TZS 580.22 billion. This contrasts with August 2024, when turnover was only TZS 112.19 billion, underscoring the rapid growth in fixed income participation.

Government bonds continued to dominate activity, particularly the 25-year bond with a 15% coupon rate and the 20-year bond with a 15.49% coupon. Oversubscription trends persisted, reflecting investor preference for longer-tenor instruments. Yields generally remained stable, reinforcing market confidence in macroeconomic stability.

Figure 2: Performance in Treasury Bond Auction

4. Investor Participation

Investor participation in August 2025 highlighted stronger domestic demand. Tanzanians accounted for 68.9% of total sales and 82.2% of total purchases, compared to foreign investors’ 31.1% of sales and 17.8% of purchases. The month recorded a net foreign outflow of TZS 14.45 billion, narrower than July’s TZS 33.20 billion outflow. This indicates a slight moderation in foreign selling pressure, while domestic investors remained net buyers, providing stability to the market

Outlook

Equities:The equity market is expected to stay positive in the short term, boosted by strong performances in banking (CRDB, NMB, and DCB) and cement stocks (TCCL, TPCC). The impressive gains in banks like DCB and MKCB show increasing investor interest in high-growth local stocks.

However, consumer-focused companies such as Tanzania Breweries (TBL) may face pressure due to weak demand and higher costs. Cross-listed stocks like KCB continue to enhance market depth, providing regional diversification.

Bonds:The fixed-income market remains robust, with turnover surpassing TZS 600 billion in August 2025. Oversubscription of longer-term government bonds indicates high investor confidence in Tanzania’s macroeconomic stability. Stable inflation and steady monetary policy are expected to sustain demand, although yields may slowly decrease as competition for longer-term bonds increases.

For rational investors, existing bonds in the secondary market are likely to stay more attractive when new bonds are issued at lower coupon rates, since they provide higher yields. This could boost demand for existing bonds.

Investor Flows:Net foreign outflows narrowed in August, and this trend may continue if global risk sentiment stabilizes. Domestic institutional investors are likely to remain the main market drivers, providing resilience against external shocks.

Overall Outlook

With supportive economic fundamentals, a stable shilling, and ongoing capital market reforms, Tanzania’s capital markets are well-positioned for continued growth in both equities and bonds. Short-term volatility is possible, but the medium-term outlook is bullish.

Best Regards;

Department of Research and AnalyticsMobile: +255 762 367 347

Email: research@alphacapital.co.tz

Location: 8th Floor, Millennium Tower I, Dar es Salaam, Tanzania

Twitter:https://x.com/AlphacapitalTz?t=syMgdAEZeWzsqqPcanh5gQ&s=08

LinkedIn:https://www.linkedin.com/company/alpha-capitaltz/

WhatsApp Group:https://chat.whatsapp.com/E7W8BuWZj7eGqXghy