Monthly Market Report

31st May 2025

1. Market Overview:

In May 2025, the Tanzanian capital market showed a mixed performance compared to April 2025. Strong activity in the primary bond market was observed while the secondary bond market and equity volume traded declined. Equity turnover increased sharply while trading volumes fell, driven by block trades on high-ticket prices of Tanzania Cigarette Company (TCC) and Tanzania Breweries Limited (TBL). Although government bond auctions were oversubscribed, reflecting solid investor confidence, secondary bond trading slowed, indicating a shift towards retail participation.

2. Equity Market Performance

2.1 Index Movement

The DSE All Share Index (DSEI) posted a gain, closing at 2,359.91 by the end of May 2025. This represents an increase of 3.32% compared to

the end of April 2025 and a year-on-year growth of 14.4% from May 2024.

The Tanzania share index also gained, closing at 4,996.99 by the end of May 2025. This represented an increase of 152 basis points compared to the end of April 2025 and an 11.04% year-on-year growth from April 2024.

2.2 Turnover & Volume

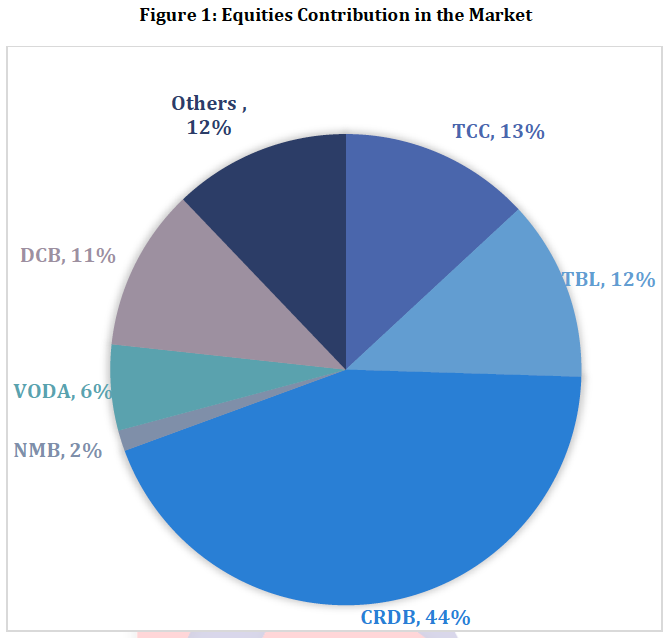

Data suggest a notable divergence between turnover and the volume traded during May 2025. The Dar es Salaam Stock Exchange (DSE) recorded a turnover of TZS 50.607 billion, reflecting a substantial 64% increase compared to April 2025. In contrast, the volume of shares traded decreased by 35% over the same period. This trend was primarily driven by the block trade on the counter of Tanzania Cigarette Company (TCC) and Tanzania Breweries Limited (TBL), which accounted for 40% and 34% of the total turnover, respectively, but only contributed 13% and 12% to the total volume traded in May 2025.

2.3 Top Movers

The top movers of May 2025 were Tanzania Cigarette Company (TCC), Tanzania Breweries Limited (TBL), and CRDB plc. These counters managed to trade 13% (equivalent to 2.75 million shares), 12% (equivalent to 2.61 million shares), and 44% (equivalent to 9.25 million shares) of the total volume of 21.07 million shares traded, respectively.

Figure 1: Equities Counter Contributions

3. Bond Market Update:

In May 2025, the bond market exhibited mixed performance, marked by strong participation in primary market auctions alongside a decline in activity in the secondary market. The Bank of Tanzania (BoT) reopened two bonds that met

significant investor demand, while the secondary market recorded low face value and turnover compared to April and March 2025. The primary and secondary market activity divergence reflects evolving investor preferences, indicating increased retail investor participation.

May 2025 experienced strong activity in the primary bond market. The Bank of Tanzania (BoT) successfully reopened two government bonds: a 25-year bond with a 15.75% coupon rate and a 5-year bond with a 13% coupon rate. Both issues saw oversubscription, with total tenders amounting to TZS 794,455.90 billion

for the 25-year bond and TZS 114,370.3 billion for the 5-year bond. The average yields to maturity were 15.2874% and 12.9424%, respectively.

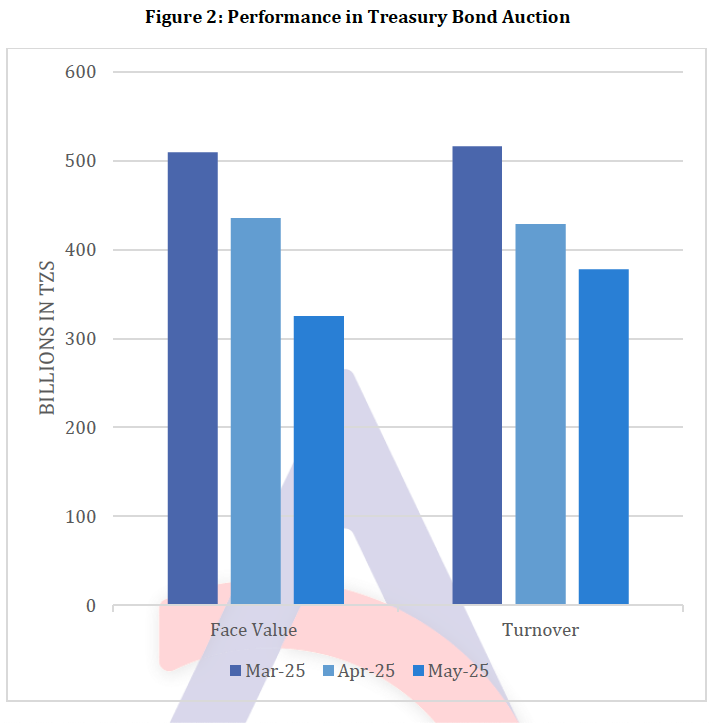

The secondary bond market exhibited notable fluctuations in activity during March, April, and May 2025. In March, the total face value of bonds traded reached an impressive TZS 509 billion. However, April witnessed a decrease, with the face value trading dropping to TZS 435 billion.

The downward trend continued into May, where activity further declined to TZS 325 billion. This represents a significant reduction of approximately 25.3% from April and a 36% decrease from March. Likewise, the turnover reached TZS 516.07 billion in March 2025, which fell to TZS 428.9 billion in

April and further declined to TZS 377.6 billion in May. This represents 12% from April and a 26.8% decrease from March

4. Investor Participation

Local investors dominated the Market on the demand side, with the participation of local investors being 65.51% and 39.86% on the demand and supply side, respectively, while the foreigners participated by 34.49% and 60.14% on the demand and supply side, respectively, resulting in a foreign outflow of TZS 30.435 billion.

Outlook

Equities:Data suggests a cautiously optimistic outlook, with the recent capital market reforms (particularly changes to the DSE trading rule) showing a promising positive trajectory. Also, the GDP growth rate is a supportive indicator, suggesting a favorable environment for investing in equities.

Bonds:Longer tenor bonds continue to attract significant interest, supported by moderate inflation and monetary consistency. As demand for these bonds increases, yields tend to fall in both the primary and secondary markets.

Best Regards;

Department of Research and AnalyticsMobile: +255 762 367 347

Email: research@alphacapital.co.tz

Location: 8th Floor, Millennium Tower I, Dar es Salaam, Tanzania

Twitter:https://x.com/AlphacapitalTz?t=syMgdAEZeWzsqqPcanh5gQ&s=08

LinkedIn:https://www.linkedin.com/company/alpha-capitaltz/

WhatsApp Group:https://chat.whatsapp.com/E7W8BuWZj7eGqXghy