Monthly Market Report

31st March 2025

1. Market Overview:

In March 2025, the Tanzanian capital market maintained its upward momentum, building on the positive performance observed in February 2025. The market outlook remained optimistic, supported by strong activity in both equity and fixed income (bond) segments. Notably, this growth was driven by successful government securities’ auctions and heightened demand in the secondary market, contributing to overall market strength.

2. Equity Market Performance

2.1 Index Movement

The DSE All Share Index (DSEI) posted a gain, closing at 2,299.95 by the end of March 2025. This represents an

increase of 28 basis point compared the end of February 2025 and a year-on-year growth of 28.4% from March 2024.

The Tanzania share index (TSI) also posted a gain, closing at 4882.64 by the end of March 2025. This presented an

increase of 1.3% compared to the end of February 2025 and a year-on-year growth of 9.4% from March 2024.

2.2 Turnover & Volume

Data suggests a notable divergence between turnover and the volume traded during March 2025. The Dar es Salaam Stock Exchange (DSE) recorded the turnover of TZS 60.58 billion, reflecting a substantial 74% increase compared to February 2025. In contrast, the volume of shares traded declined by 36% over the same period. This trend was primarily driven by an increase in block trades, particularly on the Tanzania Cigarette Company (TCC) and Tanzania Breweries Limited (TBL) counters, which accounted for 41.7% and 36.33% respectively to the total turnover of March 2025.

2.3 Top Movers

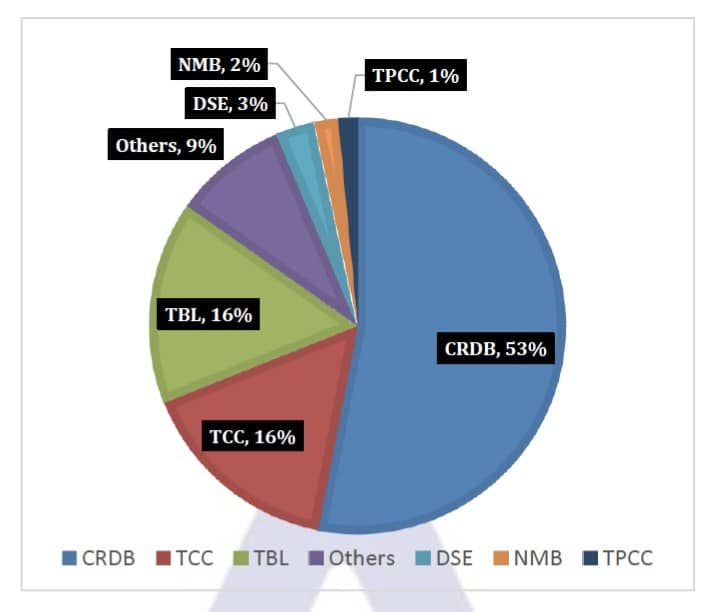

The top movers in March 2025 were CRDB Plc, Tanzania Cigarette Company (TCC) and Tanzania Breweries Limited (TBL). These counters managed to trade 53% (equivalent to 11.3 million shares), 15.9% (equivalent to 3.4 million shares) and 15.8% (equivalent to 3.37 million shares) of the total volume of 21.35 million shares traded on March 2025, respectively.

Figure 1: Equities Counter Contributions

3. Bond Market Update:

Auction results during March 2025 suggest a healthy fixed-income market, with a favourable demand outlook,

well-anchored yield expectations, and increasing in investors’ confidence in longer-duration instruments.

March 2025 witnessed robust activity in the bond market, particularly in the primary segment. The Bank of

Tanzania (BoT) successfully auctioned two new government bonds- a 5-year bond at 13% coupon rate and- a 15-

year bond at 14.5% coupon rate. Both issues were oversubscribed, with total tenders amounting to TZS 198.8

billion for the 5-year bond and TZS 262.4 billion for the 15-year bond. The weighted average coupon yields were

13.0677% and 14.6268% respectively.

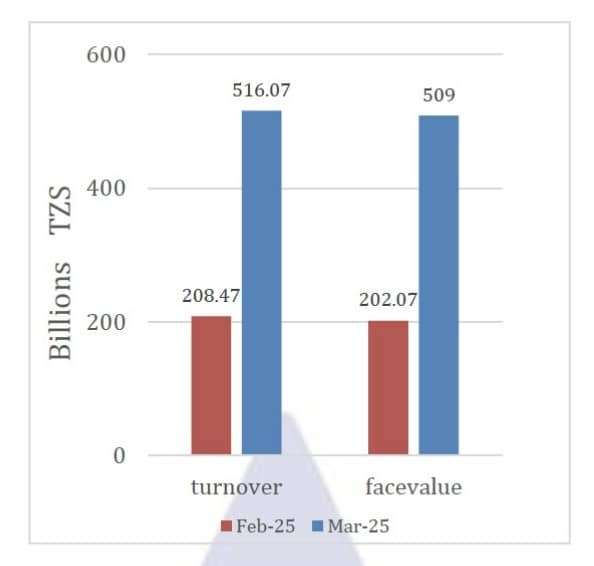

The secondary bond market experienced a substantial uptick in activity during March 2025 compared to the

previous month. The total face value of bonds traded surged to TZS 509 billion, up from TZS 202.07 billion in

February, while turnover rose sharply to TZS 516.07 billion, compared to TZS 208.47 billion. This reflects an

impressive growth of approximately 152% in face value and 147% in turnover. Additionally, the number of

transactions increased from 351 to 406, indicating heightened investor participation and improved market

liquidity.

In short, March 2025 marked a significant expansion in Tanzania’s secondary bond market, characterized by increased investor participation, stronger liquidity, and rising confidence. This trend supports broader capital market development and reflects positively on the effectiveness of monetary and fiscal policy in stabilizing and growing the economy.

4. Investor Participation

Local investor continued to dominate the Market on both the demand and supply side, the participation of the local investor was 98.6% and 60.03% on the demand and supply side respectively while the foreigner participated by 1.3% and 39.97% respectively resulting to a foreign outflow of TZS 23,4 billion

Best Regards,

Research & Financial Analytics,

Tel: +255 762 367 347

Mob: +255 763 631 999

Email: research@alphacapital.co.tz

Twitter:https://x.com/AlphacapitalTz?t=syMgdAEZeWzsqqPcanh5gQ&s=08

LinkedIn:https://www.linkedin.com/company/alpha-capitaltz/

WhatsApp Group:https://chat.whatsapp.com/E7W8BuWZj7eGqXghy